The biggest mistake in ERP planning is equating the initial cost with the “Total Cost of Ownership (TCO).” For finance leaders, understanding the true 5-year TCO is the difference between a strategic investment and a recurring financial burden. This article provides the insights needed to make confident, data-driven ERP decisions.

For most organizations, choosing an ERP system is one of the biggest financial decisions they make in a decade. It influences how daily operations run, how data flows across departments, and how leadership teams plan and deliver business outcomes. Because ERP adoption is such a large and long-term decision, CFOs must treat it as a strategic investment rather than a routine software purchase.

What makes ERP different from other IT systems is the scale of influence it has on the entire business. Once deployed, the system becomes the backbone of finance, accounting, operations, inventory, supply chain, human resources, and customer-facing processes. That is why CFOs are expected to go beyond license pricing and carefully analyse the complete lifecycle cost, from the day of implementation to the next five or ten years of running the system.

This is also why modern CFOs pay closer attention to Total Cost of Ownership (TCO). Most ERP failures, budget overruns, and implementation delays happen because organizations underestimate costs that do not appear on the initial vendor quote. These include customization maintenance, training, upgrades, integration work, support, system expansion, and operational change.

With the rise of cloud solutions like NetSuite, the TCO model has changed significantly. Companies now spend less on hardware, infrastructure, and upgrades, but must understand subscription scalability, integration tools, and ongoing optimization. Cloud ERPs offer predictable pricing, but they still require a well-planned financial evaluation to avoid unexpected expenses. This article also breaks down each cost component that CFOs must evaluate before finalising an ERP investment. It offers clarity, structure, and real-world insights to help finance leaders make confident, data-driven ERP decisions.

What Is the Total Cost of Ownership (TCO) in ERP?

Total Cost of Ownership is the complete financial picture of what an ERP system will cost your business across its entire useful life. While vendors often highlight only subscription fees or implementation costs, TCO provides a full and accurate estimate that includes:

TCO = Acquisition Costs + Operating Costs + Evolution Costs

TCO vs Upfront Cost — Why They Differ

Upfront cost includes:

- Software licenses

- Implementation pricing

- Initial training

- Hardware / Infrastructure costs

However, long-term ERP cost includes much more:

- System enhancements

- Ongoing support

- Upgrades

- Integration maintenance

- New user licenses

- Data storage

This difference is why many ERP implementations appear “cheap” initially but end up costing significantly more over several years.

TCO Matters for Budgeting and Planning

A correct TCO evaluation helps CFOs:

- Build accurate budgets

- Avoid unexpected cost escalations

- Plan resources for ongoing support

- Justify ERP investment to the board

- Forecast ROI and payback period

- Ensure financial discipline throughout the project lifecycle

Understanding TCO early ensures your ERP remains a long-term growth investment, not a recurring financial burden.

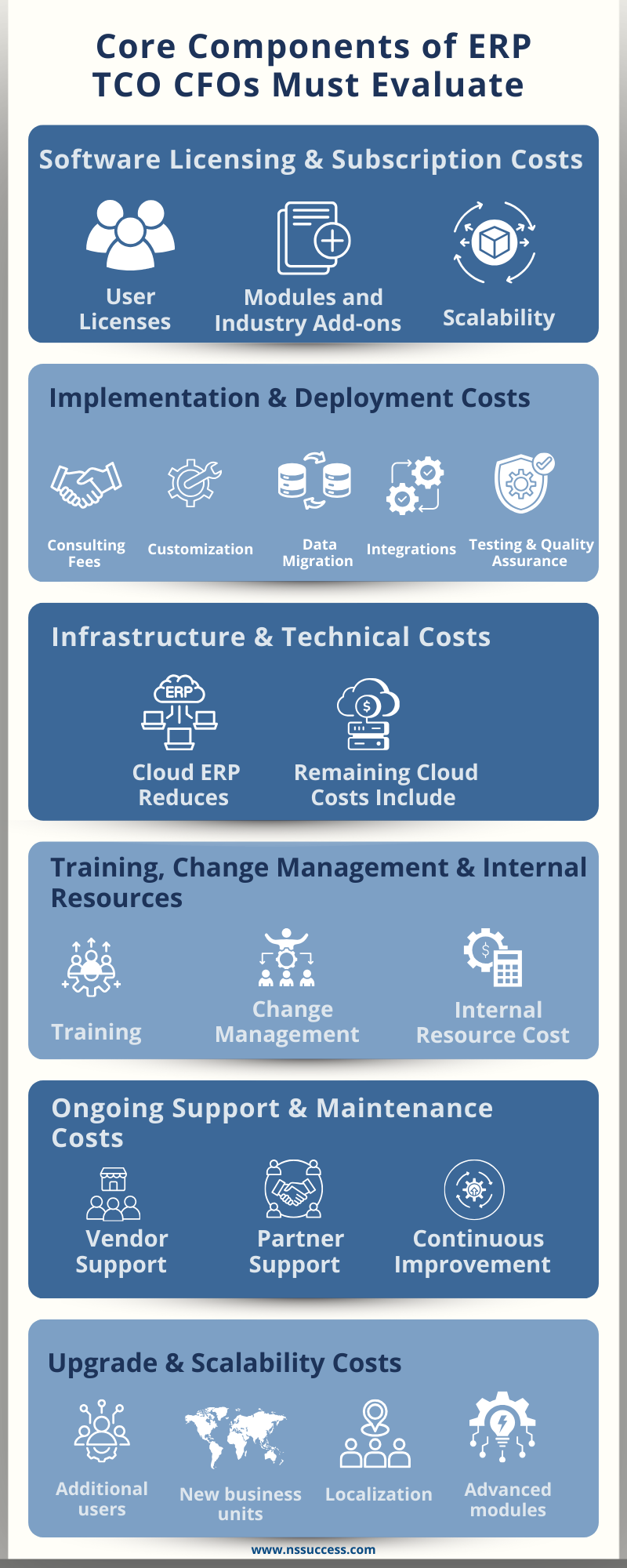

Core Components of ERP TCO CFOs Must Evaluate

Below are the major cost components every CFO must evaluate before selecting an ERP system.

A. Software Licensing & Subscription Costs

Modern cloud ERPs like NetSuite use a subscription-based model, charged annually. These fees depend on several factors:

User Licenses

- Full users

- Employee self-service

- Finance-only users

- Admin users

The more employees onboard the system, the higher the subscription cost.

Modules and Industry Add-ons

NetSuite includes core financials, but other modules may require additional subscriptions:

- Inventory

- Manufacturing

- CRM

- Revenue recognition

- Project management

- HR modules

Industry-specific add-ons (SuiteApps) can also influence cost.

Scalability

Subscription fees grow as your company grows:

- More users

- New subsidiaries

- New geographic expansions

- Additional local tax requirements

CFOs must plan for expected business growth when calculating the long-term TCO.

B. Implementation & Deployment Costs

This cost category varies greatly across organizations and is often the largest investment after licensing.

Major components include:

Consulting Fees

Implementation partners charge for expert services such as:

- Requirement workshops

- Process mapping

- System configuration

- Workflow automation

- Financial controls setup

Customization

While NetSuite encourages configuration over customization, some companies require:

- Custom scripts

- Advanced workflows

- User-specific dashboards

- Special approval routing

More customizations mean higher initial costs and higher long-term maintenance costs.

Data Migration

Migration complexity depends on:

- Data quality

- Number of legacy systems

- Volume of records

- Data cleansing needs

Poor data quality can significantly increase this cost.

Integrations

Connecting NetSuite to your existing tools involves:

- CRM

- HRIS

- POS

- Banking

- E-commerce

- Warehouse systems

Integration work requires middleware tools like Celigo, Mulesoft, or Boomi.

Testing & Quality Assurance

Includes:

- User acceptance testing

- System integration testing

- Defect resolution cycles

- Parallel run costs

A strong testing phase prevents post-go-live disruptions.

C. Infrastructure & Technical Costs

Cloud systems reduce most hardware-related expenses, but not all.

Cloud ERP Reduces:

- Server installation

- Storage maintenance

- Server security

- Backup systems

- Hardware depreciation

Remaining Cloud Costs Include:

- Integration middleware

- Additional storage (rare but possible)

- Connectivity and network improvements

- API usage for advanced integrations

By moving to cloud, companies free themselves from heavy IT infrastructure costs, making ERP financially easier to maintain.

D. Training, Change Management & Internal Resources

ERP success depends on people adopting the system.

Costs include:

Training

- Finance team training

- End-user training

- Admin-level training

- Creation of manuals and SOPs

- Internal walkthroughs and reviews

Change Management

- Communication plans

- User readiness programs

- Workshops and pilot sessions

Internal Resource Cost

ERP implementation requires internal staff involvement:

- Finance managers

- Department heads

- Project managers

- Business analysts

Their time investment is often overlooked but must be included in TCO.

E. Ongoing Support & Maintenance Costs

After go-live, organizations incur:

Vendor Support

- Standard support

- Premium support

- Dedicated account managers

Partner Support

- Monthly optimization

- Bug fixes

- Enhancement requests

- New workflow development

Continuous Improvement

As business evolves, the system must adapt:

- New automation needs

- New reporting requirements

- New modules

- Process improvements

Ignoring ongoing support results in inefficient systems and frustrated users.

F. Upgrade & Scalability Costs

Cloud ERPs like NetSuite automatically update the system twice a year:

- No additional cost

- No downtime

- No IT team effort

But scalability still affects long-term cost:

- Additional users

- New business units

- Localization

- New markets

- Advanced modules required for expansion

CFOs must plan for scale, especially if the company expects to grow into new regions.

Hidden Cost Factors CFOs Often Overlook

Beyond the obvious cost categories lie several hidden factors that can dramatically impact TCO:

- Poor Data Quality: Poor data quality represents one of the most expensive hidden costs. When migrating from legacy systems, data cleansing efforts can expand dramatically if source data contains duplicates, inconsistencies, or incomplete records. Organizations that underestimate data quality issues often face extended implementation timelines and inflated costs.

- Over-Customization: Over-customization creates technical debt that compounds over time. While customization can address unique business requirements, excessive customization increases maintenance complexity, complicates upgrades, and requires specialized knowledge. Each customization represents an ongoing cost as it must be maintained, tested with every update, and documented for future administrators.

- Incorrect Module Selection: Incorrect module selection due to inadequate upfront planning leads to purchasing functionality you don’t need while lacking capabilities you do. This miscalculation results in both wasted subscription costs and potential re-implementation expenses to add missing functionality.

- Legacy Integration Requirements: Legacy integration requirements can surprise organizations when specialized connectors, custom API work, or middleware platforms prove necessary to maintain connections with systems you can’t immediately replace. These integration costs persist as ongoing expenses.

- User Adoption Delays: User adoption delays impact operational productivity more severely than most organizations anticipate. When users struggle with the new system, work slows, errors increase, and workarounds emerge that undermine intended process improvements. The productivity cost during extended adoption periods can exceed implementation expenses.

- Reporting & Analytics Needs: Reporting and analytics needs frequently exceed initial estimates. Organizations discover post-implementation that standard reporting doesn’t meet all requirements, necessitating additional development of custom reports, dashboards, or connections to business intelligence platforms.

Cost Advantages of Cloud ERP (NetSuite) vs. On-Premise Systems

| Feature | On-Premise (Legacy) | Cloud ERP (NetSuite) |

|---|---|---|

| Upfront Cost | High (Servers + Licenses) | Low (Subscription) |

| IT Staffing | High (DBAs, Network Admins) | Low (Business Analysts) |

| Upgrades | Expensive, risky projects | Automatic, included |

| Remote Access | Requires VPN / Citrix costs | Native (Internet only) |

| Predictability | Unpredictable (Hardware failure) | Predictable (Fixed fee) |

| Scalability | Complex (Requires hardware purchase) | Native (Add licenses / modules) |

Financial Risks of Choosing the Wrong ERP or Miscalculating TCO

The consequences of inaccurate TCO analysis or poor ERP selection extend beyond budget overruns to fundamental business impact:

- Budget overruns during implementation occur when organizations underestimate costs, discover unexpected requirements, or experience scope creep. These overruns strain budgets, delay other investments, and undermine confidence in the technology organization.

- Costly rework emerges from poor upfront planning. When requirements aren’t thoroughly documented or business processes aren’t properly mapped, implementations require revision cycles that multiply costs and delay value realisation.

- Technical debt from unnecessary customizations creates ongoing drag on the organization. Each customization requires maintenance, testing, and documentation. Over time, technical debt accumulates to the point where routine updates become complex projects and simple changes require extensive impact analysis.

- Inefficiency and user frustration reduce ROI when systems don’t align with actual workflows or prove difficult to use. Productivity suffers, errors increase, and the promised efficiency gains fail to materialise. In severe cases, organizations abandon implementations and start over, wasting millions in sunk costs.

- Higher long-term operational costs result when organizations focus exclusively on minimising upfront expenses. A cheaper implementation that requires more ongoing support, generates more maintenance work, or lacks scalability ultimately costs more over the system’s lifecycle than a higher-quality initial deployment.

How CFOs Can Reduce TCO: Practical Strategies

Smart CFOs employ specific strategies to optimize ERP TCO without sacrificing capability or future flexibility:

- Conduct a pre-implementation financial readiness audit that honestly assesses your organization’s capacity for change, data quality baseline, and true requirements. This upfront investment in planning prevents expensive course corrections during implementation.

- Prioritize essential modules first and expand gradually rather than implementing all possible functionality immediately. This phased approach reduces initial costs, allows users to master core capabilities before adding complexity, and enables you to validate ROI before expanding investment.

- Choose configuration over customization whenever possible. Modern ERP platforms offer extensive configuration options that address most business requirements without custom code. Configuration leverages vendor-supported functionality that updates automatically, while customization creates technical debt.

- Use standardised best practices like SuiteSuccess for NetSuite, which packages proven configurations for specific industries and company sizes. These templated approaches reduce implementation costs, accelerate deployment, and leverage collective wisdom from thousands of prior implementations.

- Optimize integrations using modern iPaaS platforms like Celigo or MuleSoft that minimize custom code. Pre-built connectors and integration templates reduce development costs, accelerate deployment, and simplify ongoing maintenance compared to custom API development.

- Invest in training to accelerate adoption and reduce long-term support costs. Organizations that prioritise comprehensive training see faster productivity recovery, fewer support tickets, and better system utilization. The upfront training investment pays dividends through reduced ongoing support needs.

- Review usage annually to identify and eliminate unused licenses, unnecessary modules, or underutilised features. Regular audits prevent subscription cost creep and ensure you’re paying only for capabilities that deliver value.

TCO Evaluation Framework for CFOs

A structured approach to TCO evaluation ensures comprehensive analysis and informed decision-making:

Step 1: Identify business requirements and scope through detailed process mapping and stakeholder interviews. Document must-have capabilities versus nice-to-have features. Understand your growth trajectory and how requirements might evolve over your planning horizon.

Step 2: Map all cost elements across five years using the categories detailed above. Build a comprehensive model that captures licensing, implementation, infrastructure, personnel, training, support, and evolution costs. Use ranges rather than point estimates to reflect uncertainty in areas like customization needs or training requirements.

Step 3: Compare cloud versus on-premise lifetime costs using your five-year model. Include the capital costs, depreciation, maintenance, upgrade expenses, and IT personnel requirements of on-premise systems against the subscription, reduced infrastructure, and automatic update advantages of cloud platforms.

Step 4: Evaluate partner implementation proposals with TCO in mind. The lowest-cost implementation bid often leads to the highest TCO through inadequate planning, inexperienced resources, or poor quality that requires remediation. Evaluate proposals based on total delivered value, not just implementation price.

Step 5: Calculate expected ROI and payback period based on realistic benefit assumptions. Quantify efficiency gains, cost reductions, and capability enhancements the ERP enables. Compare these benefits against your total TCO to determine whether the investment generates acceptable returns.

Step 6: Conduct risk assessment and scenario planning to understand how TCO might vary under different conditions. Model scenarios for faster or slower growth, implementation challenges, or delayed adoption. This sensitivity analysis helps you understand the range of potential outcomes and plan appropriate contingencies.

CFO Tip: Always calculate five-year TCO rather than one-year costs. ERP systems represent multi-year investments where upfront expenses amortise over extended operational periods. One-year analysis creates misleading comparisons that don’t reflect true economic value.

Real-World Example: How One CFO Reduced TCO with NetSuite

A mid-sized manufacturing company was struggling with escalating IT costs from their aging on-premise ERP system. Annual maintenance contracts continued rising, their technical team spent excessive time on infrastructure management rather than business enablement, and hardware refresh cycles consumed capital that leadership wanted to redirect toward growth initiatives. Month-end close processes stretched across ten days, limiting the organization’s financial agility.

The CFO led a comprehensive TCO analysis comparing their current state against cloud ERP alternatives. The analysis revealed that over a five-year period, migrating to NetSuite would reduce TCO by approximately 35% while delivering superior functionality and eliminating technical risk.

Post-implementation results exceeded expectations. Hardware and infrastructure costs dropped to zero. The close cycle compressed from ten days to four, enabling faster decision-making and improving working capital management.

The IT team shrank by two positions through attrition while becoming more strategic and business-focused. User satisfaction improved dramatically as system performance and reliability increased.Most importantly, the predictable subscription model simplified budget planning and freed capital for strategic investments in product development and market expansion. The CFO noted that the financial predictability alone justified the migration, even before considering operational improvements and reduced technical risk.

Why Choosing the Right Implementation Partner Impacts TCO

- Expert partners design leaner, scalable systems.

- Avoid over-customization, lowering maintenance costs.

- Strong governance reduces budget overruns.

- Better training ensures faster adoption.

At NSSuccess, we approach every engagement with TCO optimization as a core objective. Our TCO-focused ERP assessments identify opportunities to reduce costs while maximising value.

We design optimised configurations that balance capability with simplicity, avoiding unnecessary complexity that drives up long-term expenses. Our post-go-live support ensures continuous improvement rather than letting systems stagnate after implementation.

Conclusion:

Total Cost of Ownership analysis represents far more than a cost accounting exercise—it’s a strategic framework for technology investment decisions that impact your organization for years. Accurate TCO analysis enables CFOs to plan resources confidently, reduce implementation and operational risks, and maximize the return on ERP investments.

Cloud ERP platforms like NetSuite offer compelling advantages in the TCO equation through predictable subscription pricing, reduced infrastructure requirements, automatic updates, and scalable growth models. However, these advantages only materialise when implementations are properly planned, expertly executed, and continuously optimised.

optimised successful CFOs approach ERP as a financial transformation enabler, not merely a software deployment. They invest time in comprehensive TCO analysis, engage experienced implementation partners, and maintain strategic focus on long-term value rather than short-term cost minimization.

Ready to optimize your ERP investment? NSSuccess helps CFOs build clear financial roadmaps for ERP success through comprehensive TCO assessments, optimised implementations, and ongoing strategic support. Contact us today to begin your TCO evaluation and discover how the right ERP strategy can transform your financial operations while maximising return on investment.

“NS Success” is the NetSuite Consulting Practice of Dhruvsoft Services Private Limited – a leading NetSuite Solution Provider Partner from India – providing services worldwide …

“NS Success” is the NetSuite Consulting Practice of Dhruvsoft Services Private Limited – a leading NetSuite Solution Provider Partner from India – providing services worldwide …