Enterprise Resource Planning (ERP) systems are comprehensive platforms that unify business functions such as finance, operations, sales, procurement, and inventory management under one digital umbrella. Oracle NetSuite is a leading cloud-based ERP solution designed to provide real-time data access, automation, and business scalability for growing organizations.

Investing in an ERP like Oracle NetSuite is a high-stakes decision, especially for CFOs, CEOs, and CIOs who must ensure financial stability while enabling business transformation. The upfront costs, time commitment, and organizational change involved in an ERP implementation make it critical to justify the investment thoroughly. Building a solid financial case is not just about cost savings; it’s about aligning the system’s long-term benefits with strategic business goals, maximising operational efficiencies, and driving measurable return on investment.

Why Financial Justification Matters

ERP investments are strategic decisions that directly impact an organization’s efficiency, agility, and competitiveness. Here’s why creating a robust financial case is crucial:

- Strategic Relevance: ERP decisions shape operational capabilities and financial performance. A modern ERP system enables data-driven decision-making, efficient workflows, and business agility, core elements of competitive advantage in today’s fast-paced market.

- Board & Stakeholder Alignment: Executives and board members need data-backed ROI forecasts to sign off on ERP investments. A detailed justification ensures that stakeholders understand not only the cost but the value of the investment.

- Reduces Project Delays: A well-structured financial plan prevents project disruptions due to budgetary concerns or changing priorities. It also ensures that funds are appropriately allocated for each phase.

- Increases Stakeholder Buy-In: Demonstrating clear ROI helps align internal departments and promotes a collaborative implementation process. It fosters a shared vision for success.

Understanding the True Cost of Oracle NetSuite

A comprehensive ERP investment includes far more than licensing fees. To develop an accurate financial picture, consider the following key components:

- Licensing and Subscription Fees: NetSuite offers modular pricing, but costs can escalate with user licenses, add-on features, and industry-specific customizations. Organizations need to analyse license requirements carefully to avoid unnecessary overhead.

- Implementation and Consulting Costs: Partner fees, initial data migration, and configuration services are often required to ensure successful deployment. These costs vary based on business complexity, data volumes, and the need for third-party integrations.

- Training and Change Management: Ensuring your team is well-trained is critical. Costs include not only instructor-led sessions but also employee time and productivity loss during ramp-up. Effective change management programs can reduce resistance and speed up adoption.

- Customization and Integration: Tailoring the system to fit your business processes or integrating it with other tools (CRM, payroll, logistics) can involve additional development and support costs. Consider the cost of APIs, middleware, and custom workflows.

- Ongoing Support and Maintenance: Post-implementation support, periodic upgrades, and scalability options must be factored in for a complete Total Cost of Ownership (TCO). NetSuite’s cloud model simplifies maintenance but does not eliminate support needs.

Understanding these components helps prevent budget overruns and ensures financial transparency throughout the ERP lifecycle.

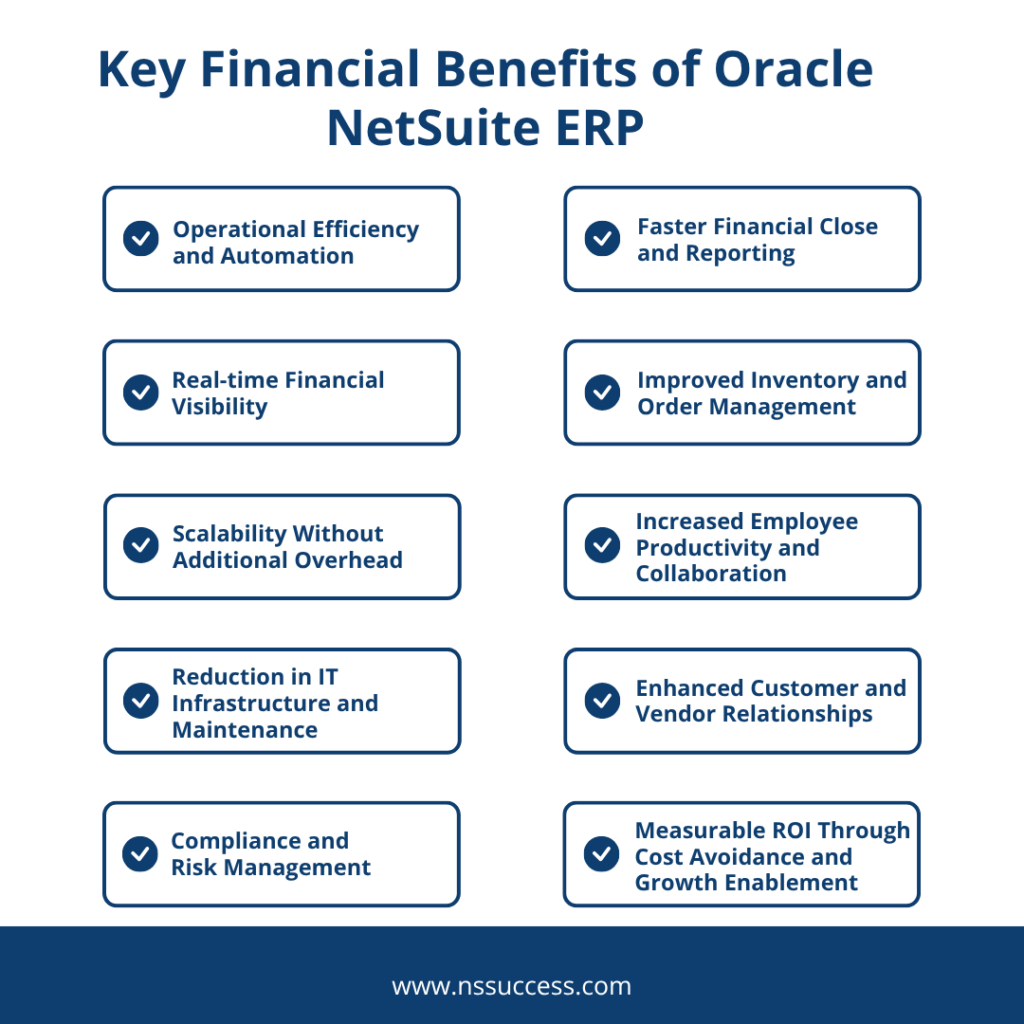

Key Financial Benefits of Oracle NetSuite ERP

Operational Efficiency and Automation

NetSuite automates repetitive and manual processes across core business functions. Whether it’s automatic invoice generation, approval workflows, or real-time inventory updates, automation reduces human error and boosts productivity. These operational efficiencies lower the cost of doing business while freeing up teams to focus on high-value initiatives. This leads to more output with fewer resources and a more agile workforce.

Real-time Financial Visibility

Oracle NetSuite’s centralised financial dashboards give decision-makers immediate access to revenue, expenses, and performance KPIs. This real-time visibility eliminates delays caused by data consolidation, enabling proactive cash flow management and better forecasting. Real-time insights support faster, data-backed decisions that can affect profitability. Decision-makers can identify trends, correct course quickly, and ensure financial discipline across all business units.

Scalability Without Additional Overhead

NetSuite’s cloud architecture supports growth without requiring investments in IT infrastructure or new data centres. Whether expanding to new markets, adding subsidiaries, or launching new products, businesses can scale their operations with minimal friction. Its modular structure allows companies to activate only the features they need, saving costs and improving flexibility. This reduces the need for future re-platforming or disruptive upgrades.

Reduction in IT Infrastructure and Maintenance

By shifting to the cloud, companies eliminate the need for expensive on-premise servers, database licenses, and maintenance teams. NetSuite handles updates, security patches, and system monitoring, allowing IT departments to focus on innovation rather than maintenance. The result is reduced IT spend, fewer system outages, and a more agile organization ready for rapid transformation.

Compliance and Risk Management

NetSuite’s built-in controls ensure full traceability and accountability through features like role-based access, audit logs, and financial reporting in compliance with global standards like GAAP and IFRS. Automated compliance reduces the risk of costly errors, legal penalties, and reputational damage while improving governance. This is particularly important for companies operating across multiple countries and jurisdictions.

Faster Financial Close and Reporting

NetSuite automates consolidation and journal entries, enabling faster month-end and year-end closes. Reports are auto-generated and compliant with regulatory standards, minimising delays and improving audit readiness. Companies that previously took weeks to close books can do so in a matter of days. This accelerates decision-making and improves investor confidence.

Improved Inventory and Order Management

Advanced inventory features, such as automated demand planning, reorder alerts, and location tracking, help reduce inventory carrying costs. NetSuite aligns procurement with actual sales demand, minimising overstocking or stock outs. These improvements enhance order fulfilment speed and customer satisfaction. Additionally, better inventory accuracy reduces shrinkage and enhances vendor negotiations.

Increased Employee Productivity and Collaboration

A unified system eliminates silos between departments. Employees can access shared data from anywhere, collaborate across functions, and make informed decisions faster. This enhanced productivity reduces the need for additional headcount and improves employee satisfaction. Real-time collaboration leads to fewer errors, better customer experiences, and faster project execution.

Enhanced Customer and Vendor Relationships

NetSuite’s 360-degree view of customers and vendors allows for personalized service, faster issue resolution, and streamlined billing and payments. Automated reminders, self-service portals, and accurate records improve relationships, shorten the cash conversion cycle, and reduce days sales outstanding (DSO). A unified view builds trust and transparency.

Measurable ROI Through Cost Avoidance and Growth Enablement

NetSuite allows businesses to scale without adding proportional back-office staff. It accelerates digital transformation, supports new business models, and enables faster geographic or product expansion. These growth enablers deliver ROI not just by cost savings, but also by unlocking new revenue opportunities. This includes supporting subscription billing, multi-entity consolidation, and omnichannel commerce.

Quantifying ROI: Metrics to Track

To demonstrate ROI, track these key performance indicators (KPIs):

- Department-wise Cost Savings: Quantify efficiencies in finance, HR, procurement, inventory, etc. Document improvements in FTE workload and system costs.

- Inventory Carrying Cost Reduction: Track how optimised stock levels reduce storage and obsolescence costs. Monitor turnover ratio and fill rates.

- Time Saved on Reporting & Compliance: Hours saved due to automation and centralised data. Report on cycle time for monthly close and audit prep.

- Order-to-Cash Cycle Improvement: Measure improvements in billing, collections, and cash inflow. Shorter cycles mean better liquidity.

- Working Capital Optimization: Monitor capital tied up in inventory or receivables. Track DSO, DPO, and inventory turnover.

How to Build the Financial Case

Perform a Cost-Benefit Analysis

Start by identifying all direct and indirect costs of implementation. Then match these against tangible and intangible benefits such as improved agility, reduced cycle times, or better compliance. Highlight both short-term wins (like IT cost reduction) and long-term gains (like scalability and resilience). Use ROI calculators or models to structure your findings.

Prepare a Total Cost of Ownership (TCO) Estimate

TCO includes licenses, partner services, integrations, training, and ongoing support. Compare this to the costs of maintaining existing systems or processes. A solid TCO model sets stakeholder expectations and prevents budgeting surprises. Consider a 3-to-5-year horizon for a complete view.

Create a Break-Even Timeline

Forecast when the benefits will offset the costs; this could be 12, 18, or 24 months, depending on the company size and rollout plan. Showing a clear timeline builds confidence in decision-makers and demonstrates financial maturity. Visual timelines or cash flow charts help communicate this clearly.

Support with Industry Benchmarks and Case Studies

Use benchmark data to contextualise your projections. For example, Gartner or IDC stats on ERP success rates, or Oracle NetSuite case studies showing 2x faster closing cycles and 30% reduction in IT costs. These comparisons validate your assumptions. Include competitor insights if available.

Tailoring the Financial Case for Internal Stakeholders

A one-size-fits-all pitch rarely works. Tailor your business case to address the unique concerns of each key stakeholder:

- CFOs are focused on ROI, budget predictability, compliance, and financial reporting improvements. Highlight how NetSuite simplifies audits and enables faster, more accurate reporting.

- CEOs are interested in business agility, growth enablement, and innovation. Emphasize NetSuite’s ability to support M&A, global expansion, and digital transformation.

- CIOs want cloud scalability, system integration, security, and innovation. Showcase NetSuite’s low-maintenance architecture, cybersecurity standards, and robust APIs.

Understanding each leader’s priorities increases the likelihood of buy-in and accelerates decision-making.

Conclusion

In today’s competitive landscape, justifying ERP investments requires more than a technology pitch; it demands a clear, evidence-based financial case. Oracle NetSuite provides a robust platform for operational efficiency, financial visibility, compliance, and growth.

By aligning NetSuite’s capabilities with measurable financial outcomes and articulating them clearly to stakeholders, organizations can build a powerful justification for investment.

Need help building your NetSuite business case? Please speak with our ERP strategy team today.

“NS Success” is the NetSuite Consulting Practice of Dhruvsoft Services Private Limited – a leading NetSuite Solution Provider Partner from India – providing services worldwide …

“NS Success” is the NetSuite Consulting Practice of Dhruvsoft Services Private Limited – a leading NetSuite Solution Provider Partner from India – providing services worldwide …