Audits are no longer limited to a once-a-year exercise. For today’s controllers, audit readiness is a continuous responsibility driven by stricter regulations, tighter timelines, and higher expectations for transparency. Auditors now expect clean data, clear documentation, and reliable controls to be available at any point—not just during audit season.

Manual processes, spreadsheets, and disconnected finance systems make this difficult. They increase the risk of errors, slow down responses to auditors, and put pressure on finance teams during already busy close cycles.

This is where Oracle NetSuite plays a critical role. Designed as a unified cloud ERP, NetSuite helps controllers maintain audit-ready financials throughout the year—not through last-minute effort, but through structured processes, built-in controls, and real-time visibility.

In this article, we explore practical best practices, key NetSuite capabilities, and process guidance that help controllers simplify audit preparation and turn audits into a predictable, low-stress activity.

The Modern Audit Landscape Controllers Must Navigate

Audit requirements have changed significantly in recent years. Controllers must now manage:

- Increased regulatory scrutiny across accounting standards, tax compliance, and internal controls

- Faster audit cycles, leaving less time for manual data preparation

- Remote and hybrid audits, where digital evidence and system access matter more than physical files

- A shift from reactive to continuous audit readiness, where auditors assess controls and data throughout the year

In this environment, relying on spreadsheets and manual reconciliations is no longer sustainable. Controllers need systems that embed audit readiness into daily finance operations.

Common Audit Challenges Faced by Controllers

Despite best efforts, many controllers face recurring audit issues, such as:

- Incomplete or inconsistent financial records across periods

- Heavy dependence on spreadsheets for reconciliations and adjustments

- Limited audit trails for transactions, changes, and approvals

- Difficulty managing audits across multiple entities, currencies, or regions

- Frequent back-and-forth with auditors for data clarification

- Inconsistent internal controls across departments and subsidiaries

These challenges don’t just delay audits—they increase audit risk and reduce confidence in financial reporting.

How Oracle NetSuite Simplifies Audit Preparation

Built-In Audit Trails

NetSuite automatically records transaction histories, edits, and approvals across the system. Every change is timestamped and linked to a specific user, providing clear answers to the auditor’s most common questions: who did what, when, and why.

This eliminates the need for manual audit logs and reduces time spent explaining transaction changes.

Role-Based Access and Segregation of Duties

NetSuite’s role-based access controls allow controllers to define who can create, approve, modify, or view financial data. This helps enforce segregation of duties and reduces fraud risk.

From an audit perspective, this makes it easy to demonstrate that strong internal controls are in place and consistently followed.

Real-Time Financial Reporting

With NetSuite, financial reports are always up to date. Controllers can access balance sheets, income statements, and cash flow reports in real time, with drill-down capabilities to transaction-level details.

This allows faster, more confident responses to auditor queries—without waiting for reports to be rebuilt or reconciled manually.

Automated Reconciliation and Close Management

NetSuite streamlines bank reconciliations, inter-company reconciliations, and period close activities. Automation reduces human error, shortens close cycles, and ensures consistency across reporting periods.

For auditors, this means fewer discrepancies and clearer reconciliation support.

Multi-Entity and Global Audit Support

For organizations operating across multiple entities or geographies, NetSuite centralizes financial data while supporting multi-currency, tax, and local compliance requirements.

Controllers can prepare audit evidence for subsidiaries and regions from a single system, reducing complexity and audit delays.

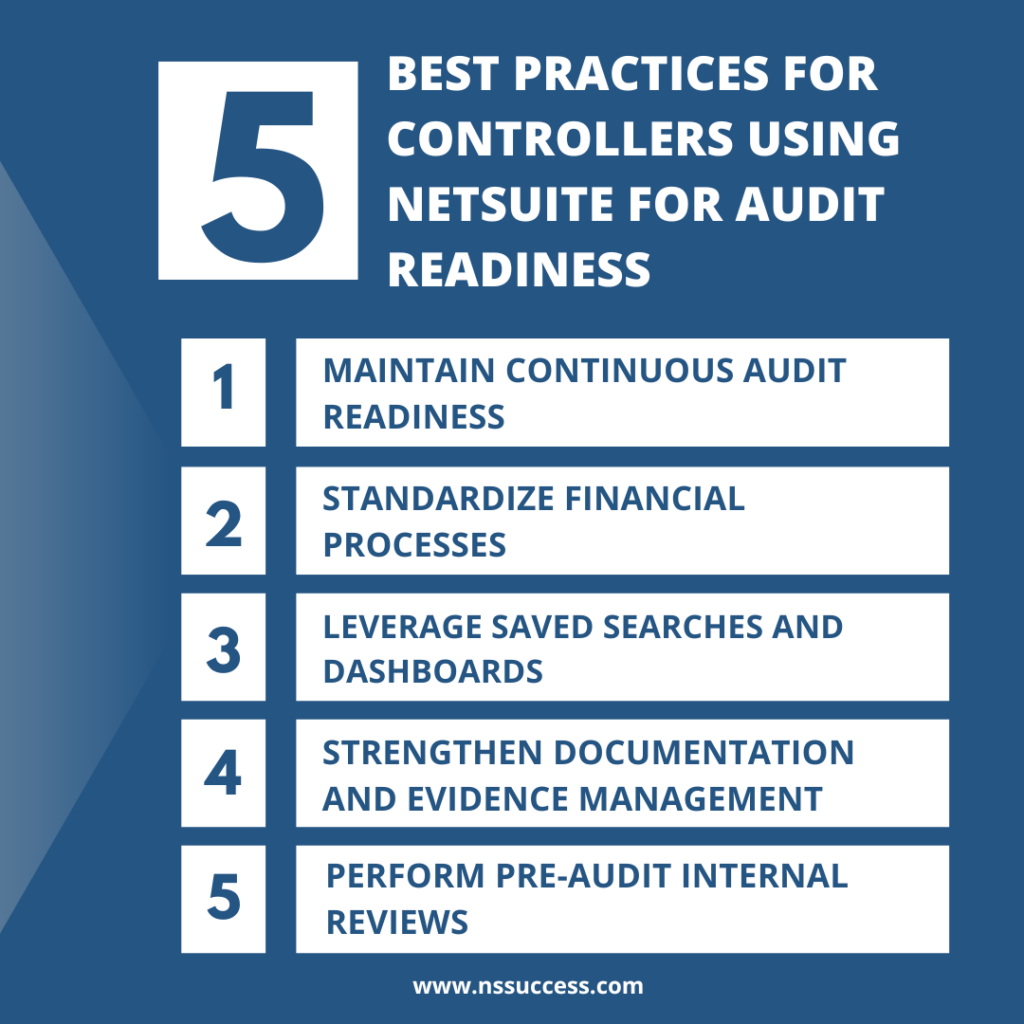

Best Practices for Controllers Using NetSuite for Audit Readiness

Maintain Continuous Audit Readiness

Audit preparation should be an ongoing activity. Controllers should regularly review transactions, approvals, and reconciliations instead of waiting until audit season.

This approach reduces surprises and spreads audit effort evenly throughout the year.

Standardize Financial Processes

Using NetSuite workflows, controllers can enforce consistent approval rules, accounting treatments, and documentation standards across departments. Standardization minimises exceptions that complicate audits.

Leverage Saved Searches and Dashboards

Saved searches and dashboards can be configured for common audit requests—such as large journal entries, manual adjustments, or unusual transactions. This gives controllers immediate visibility into potential audit risks.

Strengthen Documentation and Evidence Management

Supporting documents like invoices, contracts, and approvals can be stored directly within NetSuite transaction records. This ensures auditors can easily trace amounts back to source documents without chasing files.

Perform Pre-Audit Internal Reviews

Before auditors arrive, controllers can run internal reviews using NetSuite reports to identify gaps or inconsistencies. Fixing issues early reduces audit findings and last-minute stress.

Controller’s Audit Preparation Checklist Using NetSuite

Controllers can use this simple checklist to stay audit-ready:

- Review user roles and access permissions

- Validate reconciliations and closing balances

- Confirm approval workflows are active and followed

- Ensure all supporting documents are attached

- Run audit-specific saved searches and reports

- Verify intercompany and consolidation entries

Common Mistakes Controllers Should Avoid

Even with NetSuite, audit challenges can persist if best practices are ignored. Common mistakes include:

- Over-reliance on spreadsheets outside NetSuite

- Delaying data cleanup until audit season

- Inconsistent role and permission management

- Poor coordination between the finance and operations teams

- Underutilizing NetSuite’s built-in audit and control features

Avoiding these pitfalls significantly improves audit outcomes.

Working with Auditors More Effectively Using NetSuite

NetSuite enables a more collaborative audit process. Controllers can provide auditors with controlled, read-only access where appropriate, reducing data requests and follow-ups.

Real-time reports replace static exports, improving transparency and shortening audit timelines. Over time, this builds auditor confidence in both the system and the finance team.

The Role of an Implementation Partner in Audit Success

Technology alone is not enough. Proper configuration is critical to achieving audit readiness. An experienced NetSuite partner ensures that roles, workflows, controls, and reports are designed with audit requirements in mind.

NSSuccess supports controllers with audit-readiness assessments, configuration reviews, and continuous system optimization. Regular health checks ensure that NetSuite evolves alongside regulatory and business changes.

Conclusion

Audits do not have to be disruptive or stressful. With Oracle NetSuite, controllers gain visibility, control, and confidence across financial operations. When used proactively, NetSuite transforms audit preparation from a reactive scramble into a routine, well-managed process.

Looking to simplify your audit preparation?

NSSuccess helps controllers configure and optimize Oracle NetSuite for continuous audit readiness. Talk to our experts today and make audits a non-event.

“NS Success” is the NetSuite Consulting Practice of Dhruvsoft Services Private Limited – a leading NetSuite Solution Provider Partner from India – providing services worldwide …

“NS Success” is the NetSuite Consulting Practice of Dhruvsoft Services Private Limited – a leading NetSuite Solution Provider Partner from India – providing services worldwide …